views

The decision was approved to exempt small businesses starting in April 2020 (Sha'ban 1441), and continuing for three years (Sha'ban 1444 - March 2023)

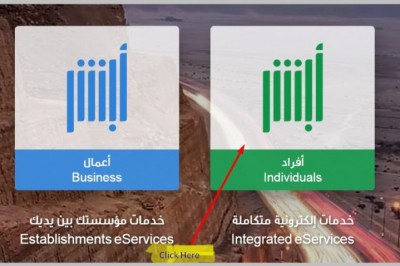

This decision exempted labor fees from work permits that were SR800 per monthly (SR9 600 annually). It was to be reduced to SR100 by electronic implementation through the Ministry of Human Resources and Social Development's electronic portal.

The details of the decision state that workers in small businesses with less than nine employees will not be charged fees. Employers can work full-time and increase the number of workers exempt to four when they hire another Saudi.

Notable is the fact that there are 576,312 establishments with 9 or fewer employees.

The ministry previously confirmed that the exemption was intended to give more flexibility in managing the contractual relationship of the employer or establishment and the expatriate worker.

It is designed to improve financial flow management with establishments in private sector and schedule their financial payments.

Comments

0 comment